Terms & Conditions

1.INTRODUCTION

The contractual relationship between you, the customer, and Kingdom Bank Corporation (hereafter, “we” “us” or “our”) is governed by these terms and conditions, along with any applicable Annexes, terms of use, and privacy policies (collectively referred to as the “Agreement”).

The terms and conditions governing the services we provide to you are outlined in this Agreement. Our pricing list (the “Pricing List”) is provided separately from these Terms and Conditions. You acknowledge that the Pricing List forms an integral part of the Agreement, and that specific pricing may vary depending on the services or products you select. Any variations from the Pricing List will be subject to your acceptance.

If there is any conflict between the Terms and Conditions, Annexes, Terms of Use, and Privacy Policy the priority shall be as indicate below;

a. Pricing List

b. Terms and Conditions

c. Annexes

d. Terms of Use

e. Privacy Policy

In the event of any inconsistency between the Terms of Use and the Terms and Conditions, the Terms of Use shall prevail solely with respect to your use of the Website, while the Terms and Conditions shall prevail in all other matters.

By registering for and using our services, you confirm that you accept, acknowledge, and agree to this Agreement in its most current form as posted on our Website, App. If you do not agree, you must refrain from using our Services. This Agreement constitutes a legally binding contract and will govern your entire relationship with us.

2. DEFINITION

Account means the customer account that is required to register and access our Services. It serves as the primary means for managing your use of our platform, including conducting transactions, accessing features, and interacting with our Services.

Agreement means these terms and conditions, along with any applicable Annexes, terms of use, and privacy policies (collectively referred to as the “Agreement”).

Annexes means additional documents or materials that are attached to and form an integral part of this Agreement. Annexes may include, but are not limited to, schedules, and/or other relevant information that provide further details or clarification regarding the terms and conditions set forth in this Agreement. All Annexes are incorporated by reference and shall have the same force and effect as if fully set forth herein.

Business Day means any day other than a Saturday or a Sunday or a public or bank holiday in Commonwealth of Dominica;

Confidential Information means any information which is marked as confidential or proprietary or should be reasonably expected to be confidential having regard to the context of disclosure or the nature of the information; including, without prejudice to the generality of the foregoing, the terms and conditions of this Agreement as well as business plans, data, strategies, methods, customer and client lists, technical specifications, transaction data and customer data (including personal data) shall be deemed confidential;

Customer (also referred as “you” “your”) means any individual or entity registered with us to use our Services, including holding deposits or conducting transactions, subject to verification and the these terms and conditions.

Customer Account means the Customer’s registered electronic money account(s) held with us in accordance with this Agreement together with such other accounts held by it with us in respect of our Services;

Customer Application Form means the application or order form provided by us and completed by you under which you apply for our Services;

Customer Liabilities means any liability that you owe us under this Agreement (actual or potential) and any amount which we reasonably determine as may be due to us with respect to any liability (anticipated or otherwise) under this Agreement related to a Payment Order or related to expected or potential Fines, Service Fees and/or refunds

Data Protection Legislation means applicable laws, rules and regulations, and any amendments or replacements to the foregoing which was signed by both Parties authorized representatives, which relate to the protection of individuals with regards to the processing of personal data (as defined in such Data Protection Legislation) including, without limitation and to the extent applicable from time to time: (i) national laws in relation with the Kingdom Bank Services and Customer; (ii) the GDPR; and (iii) any other applicable international, regional and/or national laws, regulations and rules relating to the processing of personal data and any guidance or code of practice relating to the processing of personal data issued by a relevant regulatory authority or other relevant competent authority;

Equipment means the equipment required to facilitate the processing of Payment Orders in connection with the use of our Services and includes any or all hardware, software, firmware, telecommunication or electronic devices and any or all other equipment of a similar nature;

Fines means any fines which may be imposed on us, arising related to any Payment Orders, Transactions or services subject to this Agreement provided that such Fines are supported by reasonable documentation issued by us;

Force Majeure Event means any of the following circumstances which occur, and which are beyond the reasonable control of a Party and directly prevent that Party from performing its obligations under this Agreement, being war, civil commotion, armed conflict, riot, act of terrorism, pandemic, fire, flood or other act of God (excluding any labour dispute, labour shortages, strikes or lock-outs);

General Data Protection Regulation (“GDPR”) means the EU General Data Protection Regulation 2016/679

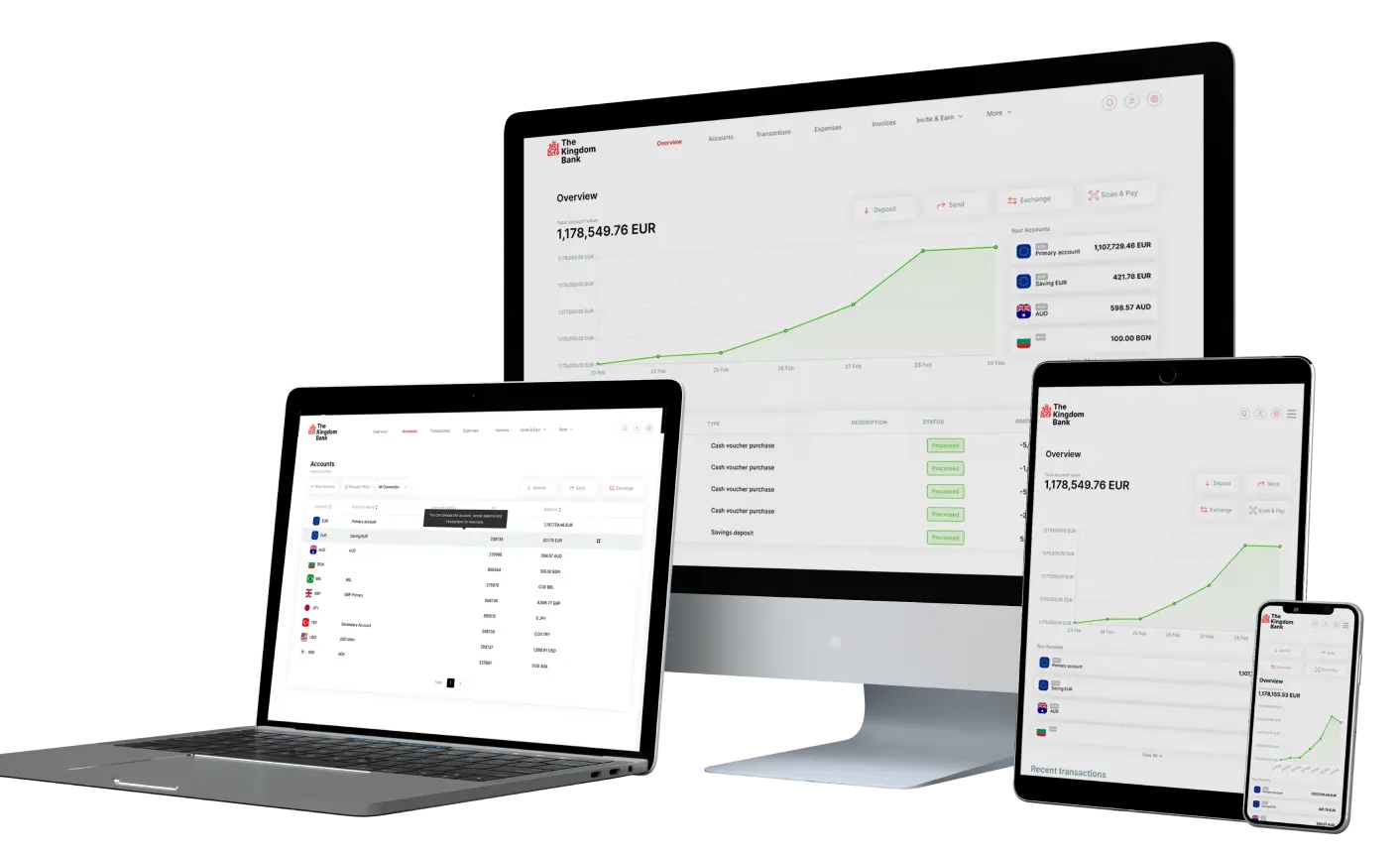

The Kingdom Bank is the trading name of The Kingdom Bank (Company number: 3159) (referred as “we”, “us” and/or “our”) and means the digital platform that is operated and owned by us where individuals and companies can use different types of services, including but not limited to a Virtual IBAN payment settlement service that allows you to send and receive payments, provided by us. We may provide Virtual IBAN payment services under different names or scope of such services may change. Any reference to us includes all services rendered by us including but not limited to Virtual IBAN payment services.

The Kingdom Bank and/or our Losses means any and all actual and reasonably proven losses incurred by us as a result of you proven any kind of direct and/or indirect fraud, risk, breach of this Agreement arising or resulting from amounts (including, unpaid Fees, proven chargebacks, settlement charges, proven Fines, expenses, refunds, reasonable fees and expenses of legal and other advisers, court costs and other dispute resolution costs), incurred by us;

The Kingdom Bank Services (the “Services”) means any services provided by us under this Agreement, including The Kingdom Bank and any other service as agreed between the Parties from time to time;

The Kingdom Bank Website (the “Website”) means the website operated by us (as amended from time to time) for the provision of its services, currently accessible at https://www.thekingdombank.com, excluding any external websites to which the website points by way of hyperlink or otherwise;

Person means an individual, a body corporate, an association, a partnership, a trust or any other entity or organization;

Personal Data means any data subject to Data Protection Legislation;

Payment Order means the payment order processed by us for you upon an instruction given by the you to us;

Pricing List means as the agreed schedule setting out the pricing for the requested the Services and used to calculate the Service Fees due by you to us, for the provision of the requested our Services as previously agreed in writing by you pursuant to a Price Quote for our Services which shall constitute the Pricing List;

Privacy Policy means our privacy policy, which is available on The Kingdom Bank’s website from time to time;

Security Incident means any incident of accidental or unlawful destruction or accidental loss, alteration, unauthorized or accidental disclosure of or access to personal data that is likely to result in a high risk to the rights and freedoms of natural persons;

Rules means any rules, regulations, procedures, guidelines and/or waivers issued by an operator of a CENTROLink or System Participant as may be amended or supplemented from time to time with which need to be complied when using our Services;

Regulatory Requirements means any applicable law, statute, regulation, order, judgement, decision, recommendation, rule, policy or guideline passed or issued by parliament, government or any competent court or authority or any payment system (including but not limited to bank payment systems, or any other payment, clearing or settlement system or similar arrangement that applies in respect of The Kingdom Bank Services hereunder);

Restricted Transactions List is a list of transactions (i) which may not be entered into using our Services, (ii) which require our prior approval, (iii) where we must notify you in advance, and (iv) where applicable those countries where certain types of transactions are illegal or do not have a legal ground, all such restricted countries are set out in The Kingdom Bank’s acceptable usage policy of the Terms and Conditions;

Security means any form of security requested by us (in its sole discretion) from you including: a bank guarantee, or other such security;

Service Fees means the fees set out in Pricing List;

Terms and Conditions means the terms and conditions which govern the use of the Account, currently available at https://www.thekingdombank.com/terms-and-conditions, as amended from time to time subject to notification in writing to the Customer in the event of any such amendment in accordance with this Agreement;

Transaction means any transaction of the Customer regarding its VIBAN provided by us.

Transaction Data means all information required in order to process a Transaction.

3. ABOUT US AND HOW TO CONTACT US

3.1. We, The Kingdom Bank Corporation, (“we”, “us” and/or “our”) an international bank incorporated under the law of the Commonwealth of Dominica with company registry number is 3159.

3.2. Our registered Head Office is at, First Floor, 43 Great George Street, Roseau, Commonwealth of Dominica Post Code: 00109-8000.

3.3. We are licensed as a bank institution under the Offshore Banking Act (the “Law”), fully authorized to provide services to clients worldwide, except for Commonwealth of Dominica citizens and residents, under the prudential supervision of the Financial Services Unit (“FSU” – http://fsu.gov.dm/). A copy of the Public Register of FSU of licensed Offshore Banks can be seen at https://fsu.gov.dm/registered-entities/search-financial-entities

3.4. If you’re an existing client and use our internet banking service the quickest and most secure way is to use the Contact Centre to send us a message, once you have logged on.

3.5. If you don’t currently use our Internet Banking service or don’t bank with the Bank, then you can email us at info@thekingdombank.com but please remember that email is not as secure as using the Contact Centre.

3.6. If you are notifying us of a security breach or security concern you should telephone the bank and confirm in writing to info@thekingdombank.com by email from the email account associated with your Account.

3.7. Write to us at the following address: The Kingdom Bank, First Floor, 43 Great George Street, Roseau, Commonwealth of Dominica Postcode: 00109-8000

4. GENERAL

4.1. References to “you” and ““your” are references to you and the person(s) accessing the Site in respect of your Account(s).

4.2. References to “Bank”, “we”, “us” and “our” are references to The Kingdom Bank Corporation, First Floor, 43 Great George Street, Roseau, Commonwealth of Dominica Postcode: 00109-8000, its successors, assigns and transferees (and including where applicable its Affiliates).

4.3. This Agreement refers to and incorporates by reference these terms and conditions, along with any applicable Annexes, terms of use, and privacy policies (collectively referred to as the “Agreement”). The terms and conditions governing the services we provide to you are outlined in this Agreement. Our pricing list (the “Pricing List”) is provided separately from these Terms and Conditions. You acknowledge that the Pricing List forms an integral part of the Agreement, and that specific pricing may vary depending on the services or products you select. Any variations from the Pricing List will be subject to your acceptance.

4.4. You acknowledge and accept the most recent version of this Agreement, as made accessible on our Website, App, by creating an account and using our Services. You should not use our Services if you disagree with the Agreement.

4.5. All our products and services are subject to the Agreement (and disclaimers) of the applicable agreement governing their use which, to the extent of any inconsistency, between the Terms and Conditions, Annexes, Terms of Use, and Privacy Policy the priority shall be as indicate below;

a. Pricing List

b. Terms and Conditions

c. Annexes

d. Terms of Use

e. Privacy Policy

4.6. Headings are for convenience only and shall not affect the construction or interpretation of this Agreement.

4.7 Unless the contrary intention appears, words in the singular include the plural and vice versa; words importing the masculine gender include the feminine and neuter and vice versa.

4.8. Any phrase introduced by the term "included", "including", "in particular" or any similar expression will be construed as illustrative only and will not limit the sense of the words preceding that term.

5.REGISTRATION OF OPENING AN ACCOUNT WITH US

5.1. To access our Services, you are required to open and maintain a customer account (the "Account"). This process involves registering with us by completing the customer application form (the "Application Form") available on our Website. By submitting your application and creating and registering to the Account, you acknowledge and agree to our Agreement, Terms of Use and Privacy Policy. We will also provide you the Pricing List which is subjected to Clause 4.3.

5.2. You will not be able to use our products or services until we have reviewed and approved your Application Form, along with the full set of documents required to meet all applicable laws, rules, and regulations, including those related to detecting and preventing money laundering and terrorist financing, as well as other credit and operational requirements.

5.3. You must always provide us with complete, accurate, and genuine information. Anytime this information changes, you have to update it. If for some reason you fail to do so, we will not be held liable for any losses. You could be asked to verify the accuracy of your information at any point, or you could be asked to submit more supporting documentation.

5.4. Upon the commencement of this Agreement and at any time thereafter, you are required to provide us with such information as we may request in order to comply with applicable regulatory requirements. This may include, but is not limited to, the following:

For individual customers:

- Your full legal name, date of birth, nationality, and residential address

- Information related to your identification, such as a government-issued ID or passport

- Your source of income or financial information, as required by applicable regulations

- Any other personal data or documents necessary for compliance with anti-money laundering (“AML”) and counter-terrorist financing (“CTF”) laws

For business customers:

- Information regarding your business or corporate structure and constitution

- Details of your shareholders, partners, members, directors, and key employees, as applicable

- For trusts, information about the beneficiaries

- Any other documentation or data needed to meet regulatory and operational requirements

- Upon our request, copies of relevant financial information and other documentation related to your business and use of the Services, including but not limited to bank references and trade references.

5.5. You grants us the right to audit the compliance with this Agreement, in particular the organizational and security measures for prevention of abuse of your system which may include but is not limited to: procedures, records and performance related to any matter referred to in this Agreement Upon audit 2 (two) weeks’ notice, you will provide to us as soon as reasonably possible the date for we to conduct the audit.

5.6. You agree to co-operate in the event of an audit request and to provide to us with reliable, truthful and complete answers to any questions that we may raise during an audit. We may retain copies of records, such to be considered “Confidential Information” issued, related to or used for the purpose of this Agreement if such copies of records are retaining, we shall use its best efforts to keep such records secure and confidential as well as comply with all applicable laws, including Data Protection Laws.

5.7. You shall assist us and facilitate such audit without limitation and at its own cost, provided that where a request under this clause is deemed by you to be excessive, you shall only bear the costs of such request in the event that the audit shows that you were in breach of this Agreement. This audit can take place only once a year unless agreed otherwise in writing by both Parties.

6. USE OF THE SERVICES

6.1. You shall not begin using our Services until the Application Form, along with all required documentation, has been reviewed and approved by us. These documents must comply with all applicable laws and regulations, including those aimed at detecting and preventing money laundering and terrorist financing, as well as our credit and operational requirements. In the event of a conflict between this Agreement and applicable rules or regulations ("Rules"), the Rules shall prevail. We will notify you of any applicable Rules in advance.

6.2. You will send and receive funds via a virtual IBAN, which will be provided by us, using the services of a third party.

6.3. You acknowledge that you rely on a third-party payment system (“System Participant”) for the provision of services under this Agreement. Accordingly, you information and documentation may be shared with the trusted System Participant. Further details on how we handle personal information can be found in the Privacy Policy.

6.4. You agree that access to our Services is governed by this Agreement and the Pricing List we provided. Our functions as an intermediary through which you can access services provided by the System Participant, with whom you hold a direct relationship.

6.5. You acknowledge that the System Participant may, at its sole discretion, conduct due diligence on you. We do not guarantee the onboarding of you by the System Participant or the provision of services by the System Participant, though we will make reasonable efforts to facilitate a suitable introduction.

6.6. Any services provided by a System Participant via us are subject to the terms and conditions of the System Participant. (“System Participant Terms and Conditions”) The System Participant bears sole responsibility for the provision or non-provision of such services. Our responsibility is limited to being the initial point of contact for any issues before redirecting matters to the System Participant, if necessary.

6.7. Our product and services depend on our securing and/or maintaining correspondent bank facilities and/or commercially viable insurance. This means that from time to time our products and services and other features of our Platform may not be available in certain markets, or at all. This could require a restructuring of that ecosystem and/or its unavailability in all or certain respects on a temporary or permanent basis.

6.8. Credit and mortgages may be available from the Bank, where applicable. Credit facilities are subject to status and mortgages are subject to security. For mortgages or other secured loans, a charge will be taken over the property;

6.8.1. Your property may be repossessed if you do not keep up repayments on a mortgage.

6.8.2. Any Bank Debit Card or Credit Card provided by the Bank is a regulated product.

7. NOTIFICATION OF MATERIAL CHANGES IN YOUR CIRCUMSTANCES

7.1. You must promptly notify us in writing of any changes to the following information, without undue delay and prior to such changes taking effect;

7.1.1. For individual customers;

(i) Your current residential address;

(ii) Any changes to your legal name or identification details;

(iii) Any changes to your employment status or source of income;

(iv) Any material changes affecting your credit or financial standing.

7.1.2. For business customers;

(i) Your current registered address;

(ii) Any "doing business as" names, trade names, and/or URLs used by you;

(iii) Changes in your business operations, including any changes in control, ownership, or constitutional structure;

(iv) Any changes to the goods and/or services you sell, lease, or distribute;

(v) Any changes in Regulatory Requirements to which your business is subject, including changes to or revocation of licenses that may adversely affect The Kingdom Bank’s compliance with applicable law or Regulatory Requirements;

(vi) Any material changes to your business's credit or financial standing.

7.2. Failure to notify us of any material changes relevant to compliance with applicable Regulatory Requirements may result in losses for which you will indemnify us, without limiting any liability provisions contained in this Agreement.

8. SECURITY OF YOUR ACCOUNT

8.1. Upon opening an Account, we will provide you with Security Features which will provide an access to your Account. It is solely your responsibility to keep safe and secure the Security Features. You agree to continuously monitor and establish security procedures and protocols applicable to the size and nature of your business and/or individual use of our Services to comply with the provisions of this clause.

8.2. To ensure the security of your Account and profile, you shall adhere to the following guidelines:

(i) Regularly change your password and ensure it is unique and not reused for other online accounts.

(ii) Never share your login credentials, including your account number and password, with anyone. If you suspect unauthorized access to your Account, contact Customer Support immediately.

(iii) Create strong passwords that utilize a mixture of letters, numbers, and symbols, and follow our recommended password guidelines.

(iv) Keep your email account secure, as it is vital for account recovery. Notify Customer Support immediately if your email account is compromised.

(v) Regularly update the App on your device to the latest version to benefit from enhanced security features.

(vi) Ensure your device's browser is updated to the latest version for optimal security.

(vii) Maintain your device’s operating system by applying the latest security updates provided by the manufacturer.

(viii) Install and regularly update anti-virus software on your device, where applicable.

(ix) Access our Services exclusively through our official App (downloaded from the iOS or Android store) or our Website at https://www.thekingdombank.com Be cautious of fraudulent ads that may lead to counterfeit websites. For guidance on avoiding phishing scams, visit our Website.

(x) If you suspect you have fallen victim to a scam, promptly contact our Customer Support team.

8.3. Upon reasonable request, you agree to secure the performance of its obligations under this Agreement. This may involve arranging the execution of a guarantee, creating a trust account or placing a legal charge over a deposit in a bank account

9. PROCESSING YOUR PAYMENT ORDERS

9.1. You unconditionally agree andinstruct us to transfer funds to the beneficiary upon provision of a Payment Order.

9.2. Once the Payment Order is submitted it becomes final and cannot be cancelled by you anymore.

9.3. We reserve the right at its sole discretion to stop or put on hold a Payment Order and request that you provide additional documents and/or information.

9.4. You may not be held liable for any interest we may receive on any funds that we hold as part of your use of our Services. Any such interest earned shall be credited to us.

10. FEES PAYABLE BY YOU TO US and TAXES

10.1. The fees payable by you for our Services are outlined in the Pricing List, which will be provided to you by your account manager. You are required to review and acknowledge receipt of the Pricing List. If you do not agree with the terms of the Pricing List or choose not to accept it, you will not be able to access our Services, and no Agreement will be formed between you and us. Although the Pricing List is provided as a separate document, it constitutes an integral part of this Agreement.

10.2. You agree that if any amounts are unpaid to us can deduct amounts as applicable equal to the Service Fees, Fines, demands or claims, refunds and/or any other owed amounts under this Agreement, or any other amount that you have agree with a third-party supplier that we may collect on their behalf.

10.3. We will notify you if you owe us any sums in relation to any demands or claims or other amounts which are owed to us (other than Service Fees, Fines or refunds) and the reasons for doing so.

10.4. You agree to be liable to us and pay us amounts which equal to any Fines and any associated costs related to the usage of or Services, Each Fine related to usage of our Services represents a debt due and payable by you to us upon issuance of the written notice and payable within 10 (ten) Business Days. You will be responsible for any associated costs and interests that accrue from the date the fines are imposed. Interests will be calculated daily and will accumulate for each day during the 10 (ten) Business Day period.

10.5. Service Fees are quoted exclusive of Value Added Tax (“VAT”). In case VAT or any other sales tax is or becomes chargeable, we will add such tax to the amount payable but shall provide the amount of tax and the applied tax rate. You are also responsible for calculating, collecting, reporting and remitting correct taxes to the appropriate tax authority. We and our Affiliates are not obligated to determine whether taxes apply to you and are not responsible for calculating, collecting, reporting or remitting on your behalf any taxes to any tax authority arising from any Payment Orders,

10.6. It is your responsibility to determine which, if any, taxes apply to the payments received, and to report and remit the correct tax to the appropriate tax authority. We are not obligated to determine whether taxes apply, and is not responsible to collect, report, or remit any taxes arising from any Transaction.

10.7. For any Service Fee payable by you shall be deducted from your Account balance. If your Account balance is insufficient, or your Account balance becomes negative, we reserve the right to invoice you Customer for any shortfall.

10.8. Where we are unable to deduct any Service Fees or other monies payable by you under this Agreement from the balance of your Account, we shall issue an invoice for the amount owed. Invoices are payable within 7 (seven) Business Day days of the date of the invoice. In case of overdue payments, we reserve the right to (i) charge interest in the amount of 2% (two percent) above the base lending rate of Bank of England per year (accruing daily); and/or (ii) suspend your Account and terminate this Agreement with immediate effect by giving written notice to you. If there is any remaining balance in your Account, we will transfer the funds to the last account you have provided to us. If no account has been indicated by you, we will contact you in writing, requesting you to provide suitable account details for the transfer of your remaining funds. If you owe us, we will notify you if you owe us any sums in relation to any demands or claims or other amounts which are owed to us (other than Service Fees, Fines or refunds) and the reasons for doing so.

11. LIMITATION OF USE OF THE SERVICES

11.1. Misuse of Our Systems and Services: You must not misuse our systems or services. This includes, but is not limited to:

(i) Breaching this Agreement, Terms of Use and/or Privacy Policy, and/or any other agreement between you and any of our entities.

(ii) Violating any applicable laws, regulations, or ordinances, including those related to financial services, consumer protection, competition, anti-discrimination, and intellectual property.

(iii) Introducing harmful materials, such as viruses, trojans, worms, or any other malicious software, or taking actions that impose an unreasonable load on our systems, websites, or networks, or launching denial-of-service attacks.

(iv) Using anonymizing proxies, automated tools (e.g., robots or spiders) to monitor or copy our websites without prior written consent or bypassing our security measures.

(v) Engaging in any defamatory, libelous, threatening, harassing, abusive, or fraudulent activity, or providing false, misleading, or inaccurate information.

(vi) Sending or receiving funds that are reasonably suspected to be associated with fraudulent activities or refusing to cooperate in investigations or identity verification processes.

(vii) Taking actions that may cause us to lose services from our suppliers (e.g., internet service providers or payment processors), or using our systems or services for prohibited or illegal activities.

(viii) Interfering with, disrupting, or attempting to gain unauthorized access to our systems, services, or the accounts of other users.

(ix) Engaging in any payments related to illegal goods or services, including but not limited to tobacco products, drugs, pornographic content, illegal downloads, gambling, or infringing on third-party intellectual property rights.

12. SUSPENSION OF THE SERVICES

12.1. We reserve the right to suspend or limit services in the event that any claims, charges, penalties, or costs owed by you under this Agreement remain outstanding.

12.2. We may suspend your account for audit purposes under the following circumstances:

12.2.1. Where necessary to protect the security of the account;

12.2.2. If transactions are suspected of breaching this Agreement, security requirements, or relating to fraudulent or illegal activities, including but not limited to money laundering or terrorism financing;

12.2.3. Upon the insolvency, bankruptcy, or similar proceedings affecting you;

12.2.4. If there is a material change in the Customer’s financial position or business operations;

12.2.5. If a "Material Change" (as defined in clause 7) occurs; we will make reasonable efforts to notify you of any suspension and provide relevant documentation, unless doing so would compromise security measures or is prohibited by law.

12.3. We may also suspend your account or certain functionalities as required by applicable laws or court orders. Reasonable efforts will be made to notify the you, unless doing so is legally prohibited.

12.4. We will promptly reinstate your account and provide new security details, such as login credentials, once the reasons for suspension no longer exist.

12.5. Notwithstanding clause 4.5, we reserve the right to suspend security features if there are reasonable grounds to suspect a security breach or unauthorized use. We will notify you of such suspensions and provide reasons, unless doing so would compromise security or violate legal obligations. Security features will be reinstated once the issue is resolved.

12.6. You acknowledge that we act solely as a service provider and does not function as a seller, buyer, dealer, or agent in any transactions facilitated through its platform. We make no representations regarding the quality, safety, or legality of your activities or transactions.

12.7. You are solely responsible for any transactions entered into. We shall not be a party to any disputes arising from such transactions. You agree to fully indemnify us against any claims, losses, or liabilities (including legal fees) resulting from third-party claims related to such transactions.

13. INTELLECTUAL PROPERTY

13.1. For the duration and strictly for the purpose of this Agreement, the Parties may grant each other a non- exclusive, worldwide, royalty-free, non-transferable license to copy, use and display any logo, trademark, trade name or other intellectual property owned by, or licensed to the other Party, to the extent that we are entitled to grant a sublicense. In such case, Parties shall agree on the terms and conditions of the Intellectual Property relationship.

13.2. Notwithstanding clause 13.1 above, we may use your, if applicable, Intellectual Property for marketing purposes without being subject to prior written approval or grant.

13.3. We reserve the right at any time and in its sole discretion to require you to stop displaying, distributing or otherwise making use of the intellectual property licensed to you by us.

13.4. Copyright in the page screens, information and material in their arrangement included in this Website is owned by or licensed to us unless otherwise noted. You may imprint, copy, download or temporarily store extracts from our Website for your personal information or when you use our products and services. You must not alter anything. Any other use is prohibited unless you first get our written permission. In particular, no one may use a part of our Site on any other website, or link any other website to our Site, without our prior written permission.

14. CONFIDENTIALITY, DATA PROCESSING AND INFORMATION SECURITY

14.1. During the term of this Agreement and thereafter, each Party shall use and reproduce the other Party’s Confidential Information only for purposes of fulfilling their obligations under this Agreement and only to the extent necessary for such purpose and will restrict disclosure of the other Party’s Confidential Information to its employees, consultants, advisors or independent contractors with a need to know, and the disclosing Party must instruct all such Persons, who are not already under an analogous duty of confidentiality, not to disclose the Confidential Information to third persons, and will ensure that said Persons have agreed to similar non- disclosure provisions to ensure the respective Party’s compliance with the terms of this Agreement, and will not disclose the other Party’s Confidential Information to any third party without the prior written approval of the other Party.

14.2. Notwithstanding the foregoing, it will not be a breach of this Agreement for either Party to disclose Confidential Information of the other Party if required to do so under law or in a judicial or governmental investigation or proceeding.

14.3. Time to time we are working with a trusted third party in order to maintain our Services and we may need to share your Confidential Information with them to give our Services to you. Therefore. notwithstanding the clause 14.1, will be considered as a breach of this Agreement for us to provide information and documents of you to a trusted third party for our Services. Notwithstanding the foregoing we warrant that such third party shall be made aware of the confidential nature of the Confidential Information shared and undertakes to be fully liable for the breach of confidentially provisions of such third parties.

14.4. The confidentiality obligations shall not apply to information that (i) is or becomes public knowledge through no action or fault of the other Party; (ii) is known to either Party without restriction, prior to receipt from the other Party under this Agreement, from its own independent sources as evidenced by such Party’s written records, and which was not acquired, directly or indirectly, from the other Party; (iii) either Party receives from any third party reasonably known by such receiving Party to have a legal right to transmit such information, and not under any obligation to keep such information confidential; or (iv) information independently developed by either Party’s employees or agents provided that either Party can show that those same employees or agents had no access to the Confidential Information received hereunder.

14.5. The provisions of this clause 14 shall bind and apply by and between the Parties for the duration of this Agreement and after the termination of same, howsoever achieved and shall continue to apply indefinitely.

14.6. The Parties agree to enter into a DPA to outline their respective obligations and duties in processing Customer’s personal data in accordance with Regulatory Requirements and Data Protection Legislation.

14.6.1. The Parties acknowledge and agree that:

i. the DPA referred to in clause 14.6 shall form an integral part of this Agreement;

ii. in the event of any conflict or inconsistency between this Agreement and the DPA referred to in clause 14.6, the terms of the DPA shall prevail with regards to the subject matter thereof.

15. CHANGES IN THIS AGREEMENT

15.1. The terms and conditions of this Agreement are subject to changes from time to time. All changes shall be made by notice from us to you under the following procedure:

15.2. We will give you notice of any proposed change to the Agreement (“Change Notice”).

15.3. A Change Notice may be sent by letter to your current or last known residential address, registered office, or by email to any of the email addresses associated with your Account. Therefore, it is your responsibility to ensure that your address and/or email address is kept up to date."

15.4. The proposed change shall come into effect automatically 2 (two)weeks after the date of receipt of the Change Notice, unless you give written notice to us that it objects to the proposed changes (in each case, an “Objection Notice”).

15.5. We may stipulate in a Change Notice a different time period for the coming into effect of any change, provided that this may not be less than 2 (two) weeks.

15.6. If no Objection Notice is received by us within the stipulated time frame, you are deemed to have accepted the change to the Agreement which will take effect on the specified effective date in notice. If we send you a Change Notice, and you fail to receive it due to not updating your address and/or email address, and we do not receive an Objection Notice from you, we will not be held liable for any changes made.

15.7. Immediate Changes: In certain circumstances, we may implement immediate changes to this Agreement. Notwithstanding Clause 15.2. and 15.5. changes that do not require Change Notice include those that are: (i) more favourable to you; (ii) mandated by law; (iii) related to the introduction of a new service or enhancements to existing services; and/or (iv) changes that do not diminish your rights or increase your responsibilities. Such changes will take effect immediately as specified in the change notice. Additionally, changes to exchange rates will take effect immediately without prior notice, and you will not have the right to contest these changes.

15.7. You have the right to terminate this Agreement with immediate effect at any time and without charge upon receiving a Change Notice, provided that such termination occurs before any changes specified in the Change Notice become effective. Any fees and/or fines pending on your balance that you owe us will be subject to deduction.

16. LIMITATION OF LIABILITY

16.1. Nothing in this Agreement shall operate to exclude or restrict a Party’s liability:

16.1.1. For fraud and fraudulent misrepresentation;

16.1.2. For remittance payments due to the Customer subject to the provisions of this Agreement;

16.1.3. For wilful and malicious misconduct;

16.1.4. For a breach of clause 14 (Confidentiality and Data Protection); and to the extent that such exclusion or restriction is not prohibited under applicable law.

16.1.5. Unless expressly stated otherwise, no indemnity obligation under this Agreement shall be subject to the limitations of liability contained in this clause 16.

- 16.2. In case of a breach by you of any of the clause 5, Clause 6, clause 9, clause 10, clause 12 and/or clause 13, the Customer shall indemnify us against all proven third-party claims, losses, damages, fines or penalties arising out of or in connection with such breach. Provided always that any contributory negligence on our part shall be taken into account so as to reasonably and proportionately reduce your liability under this clause.

16.3. We will not be liable for any of the following:

16.4. A hardware, software or internet connection is not functioning properly;

16.5. Any suspension or refusal to place the Payment Orders which we reasonably believe to be made fraudulently or without proper authorisation; The Payment Orders received contain incorrect or improperly formatted information;

16.6. Unforeseen circumstances preventing the proper performance despite any reasonable precautions taken by The Kingdom Bank. Such circumstances may include but are not limited to acts of God, power outages, fire, flood, theft, equipment breakdowns, hacking attacks, internal mechanical or systems failures as well as downtimes of The Kingdom Bank Website.

16.7. You will be responsible for proven our Losses except such losses are sustained as a direct result of the failure act or omission solely by us to perform its obligations under this Agreement.

16.8. A Party shall not be liable for any delay or failure to perform its obligations under this Agreement to the extent that it is prevented or delayed by reason of a Force Majeure Event. Any Party that is subject to a Force Majeure Event shall not be in breach of this Agreement provided that:

i. it promptly notifies the other Party in writing of the nature and extent of the Force Majeure Event causing its failure or delay in performance;

ii. it could not have avoided the effect of the Force Majeure Event by taking reasonable precautions which, having regard to all the matters known to it before the Force Majeure Event, it ought reasonably to have taken, but did not; and,

iii. it has used reasonable endeavours to mitigate the effect of the Force Majeure Event, to carry out its obligations under this agreement in any way that is reasonably practicable and to resume the performance of its obligations as soon as reasonably possible.

iv. In the event that consequences of a Force Majeure Event last longer than 1 (one) month, either Party is entitled to terminate this Agreement with a written notice of immediate effect.

16.9. Parties shall defend and hold harmless the other Party’s its employees, officers and directors from and against any and all claims, penalties, demands, losses, costs, expenses, liabilities and damages, including reasonable legal fees, that arise, result from, or relate directly or indirectly (a) to any acts or omissions, negligence, wilful misconduct or default or fraud of the Parties or its agents, employees, officers or directors, (b) any breach of or failure by the Parties in respect of any of its representations, warranties, covenants or agreements in this Agreement, (c) any infringement or alleged infringement of the intellectual property rights of a third party, or (d) any breach by the Parties or its agents or sub-contractors of applicable law, or the rules of any payment network or card scheme.

17. CLOSING YOUR ACCOUNT AND TERMINATION OF THIS AGREEMENT

17.1. You may stop using our Services and close your account at any time by following the instructions provided via our Website, App, or an API partner. This Agreement will continue until your account is officially closed.

17.2. If you choose to close your account, you must withdraw any remaining funds within a reasonable time before closing it. If there are funds left in your account upon closure, you will no longer have direct access to them, but you may still contact Customer Support to withdraw your funds for up to 6 (six) years after the account's closure.

17.3. Upon account closure or deactivation, any remaining funds may be subject to additional checks before The Kingdom Bank can return them to you

17.4 You are prohibited from closing your account or deleting your profile if there is an ongoing investigation, a pending transaction, or an open dispute. In such cases, we may hold your funds for a reasonable time to protect its interests or those of third parties.

17.5. We may prevent the closure of your account if it has a negative balance or if it is subject to a hold, limitation, or reserve.

17.6. Even after account closure, you remain responsible for any obligations related to your account or use of our Services. For instance, any outstanding negative balances must still be settled, and other post-closure responsibilities apply.

17.7. We may terminate this Agreement and close your account by providing one week’s prior written notice. Termination ends all rights granted to you in connection with the Services

17.8. Without prejudice to termination rights under the Terms and Conditions, each Party has the right to terminate this Agreement immediately:

17.8.1. If the other Party files a petition for bankruptcy, becomes insolvent, or is subject to other similar termination event;

17.8.2. Upon the occurrence of a material breach of this Agreement by the other Party if such breach is not remedied within thirty (30) days after written notice is received identifying the matter or circumstances constituting the material breach or

17.8.3. If the other Party repeatedly breaches any of the terms of this Agreement in such a manner as to reasonably justify the opinion that its conduct is inconsistent with it having the intention or ability to give effect to the terms of this Agreement;

17.8.4. If the other Party violates or fails to comply with any Regulatory Requirements or Data Protection Legislation, or any other applicable law, regulation or any order by a competent court or government authority

17.8.5. In case of a Force Majeure Event prevailing for a continuous period of more than thirty (30) days, preventing either Party from performing its obligations under this Agreement;

17.9. We have the right to terminate this Agreement with immediate effect by giving written notice to you in the following situations:

17.9.1. We have reasonably proven reason to believe that your business and/or use of our Bank Services damages, corrupts, degrades, destroys and/or otherwise adversely affects our Services, or any other software, firmware, hardware, data, systems or networks accessed or used by you;

17.9.2. There is a material change in the your type of business activities (if you are a business customer) or use of our Services.

17.9.3. We are unable to enforce any Security we may have been granted under this Agreement in connection with the usage of our Services and/or if you fail to maintain the agreed Security;

17.9.4. You have breached Clause 14.6. of this Agreement and/or any information you submit to us or any of the warranties you provide us in this Agreement are found to be untrue or misleading;

17.9.5. You refuse a request pursuant to clause 9 or fails to respond to such a request within five (5) Business Days;

17.9.6. You or The Kingdom Bank receive instructions, ordersand/or directions fromany regulatory authority or other entity having authority, competence and/or jurisdiction to terminate this Agreement.

17.9.7. We receive an Objection Notice from you.

17.10. Upon termination of this Agreement:

17.10.1. both Parties must cease using the other Party’s intellectual property, including without limitation the other Party’s name, trademarks, logos and any or all materials referring to the other Party from their respective websites and other media outlets. Each of the Parties agrees to immediately return to other Party any materials containing the other Party’s intellectual property, including without limitation the other Party’s name, trademarks, logos and any or all materials referring to the other Party;

17.10.2. you must immediately pay to us all amounts owed under this Agreement (including any Service Fees apportioned as due until the time of termination) and we will immediately pay to you all amounts owed (including any Service Fees paid in advance to be reimbursed proportionately), but in all circumstances subject to the provisions of clauses 8 (Security), clause 9 (Processing the Customer’s Payment Orders) and clause 10 (Fees payable by the Customer);

17.10.3. all licenses granted by us under this Agreement terminate immediately and you must cease to use our Services;

17.10.4. each of the Parties shall comply with the other Party’s instructions in writing concerning the return or destruction of Confidential Information of the other Party which the Parties shall have obtained as a result of this Agreement;

18. OTHER LEGAL TERMS

18.1. Warranties and the Customer Warranties

18.1.1. Each Party warrants and represents to the other Party that:

i. It has and will maintain all required rights, powers and authorisations to enter into this Agreement and to fulfil its obligations hereunder;

ii. It will perform its obligations hereunder with reasonable skill and care;

iii. It has in place and will maintain adequate facilities (including staff training, internal controls and technical equipment) to comply with its data protection obligations, in the case of The Kingdom Bank with the Data Protection Legislation, and confidentiality obligations hereunder;

iv. It is not receiving and will not, for the duration of this Agreement, receive or send funds to or from an illegal source or in connection with any illegal, fraudulent, deceptive or manipulative act or practice and

v. The Parties accept and undertake to be in compliance with the Rules.

vi. We represent and warrants that we have all the rights to provide you with The Kingdom Bank and our Services and our Services do not infringe on intellectual property rights of any third party.

vii. We represent and warrant that, if applicable, it shall hold and maintain in force all necessary licenses, certifications for the duration of this Agreement and, if such licenses and/or certifications are cancelled, amended or restricted, we will immediately notify you who will be entitled to terminate the Agreement, with immediate effect;

18.2. Assignment and Third Party Right

18.2.1. You may not assign any of its rights under this Agreement to a third party without our prior written consent;

18.2.2. We may assign any of its rights under this Agreement to a third party without your prior written consent;

18.2.3. You may not outsource the performance of any of its obligations under this Agreement without our prior written consent of , such consent not to be unreasonably withheld.

18.2.4. No person who is not a party to this Agreement shall have rights under the Contracts (Rights of Third Parties) Act 1999 or otherwise to enforce any term of this Agreement.

18.2.5. In case you;

i. Acquires another existing our customer or our business;

ii. Is acquired or its business is acquired by another existing our customer;

iii. merges with another existing our customer; or

iv. Enters into a cooperation with another existing our customer you shall pay, upon our notice to the you, either (a) its current fees or (b) the current fees applicable to the other customer or (c) such reasonable combination of its own current fees and the fees payable by the other customer as determined by us. We shall send a notice within 1 (one) month of the later of completion of the acquisition, merger or cooperation, and/or our gaining knowledge of such acquisition, merger or cooperation. If no notice is sent within this time period, you shall continue to pay its current fees. Any change to the fees will be treated as a change to this Agreement for the purposes of clause 15 ( Change of This Agreement) and the fee change shall apply on the date which is one (1) week after you receipt of the notice.

18.3. Enforcement

18.3.1. Our failure to enforce any part of this Agreement promptly does not waive our right to enforce it at a later time. If we delay in requiring you to comply with certain obligations or in taking action, this does not prevent us from taking such steps in the future.

18.4. Relationship of the parties;

18.4.1. The Customer and The Kingdom Bank are independent contractors under this Agreement, and nothing herein will be construed to create a partnership, joint venture or agency relationship between them. Neither Party has authority to enter into agreements of any kind on behalf of the other.

18.5. Relationship of the parties

18.4.1. The Customer and The Kingdom Bank are independent contractors under this Agreement, and nothing herein will be construed to create a partnership, joint venture or agency relationship between them. Neither Party has authority to enter into agreements of any kind on behalf of the other.

18.6. Non-solicitation of employees

18.6.1. Neither Party undertakes that it will not for the term of this Agreement and a period of six (6) months thereafter, on its own behalf or on behalf of any person, directly or indirectly canvass, solicit or endeavour to entice away from the other Party or an associated company any person who has at any time during the term of this Agreement been employed or engaged by either Party or an associated company.

18.7. Notices

18.7.1. Any notice to be given under this Agreement must be given in writing and delivered either by hand, first class prepaid post or other recognised delivery service, or by facsimile or by email (subject to confirmation of a non-automated receipt) as such may be designated by the Parties from time to time. Notwithstanding the foregoing, The Kingdom Bank may give notice to the Customer by sending an email to any of the email addresses registered with the Customer Account.

18.7.2. The Kingdom Bank’s Notice Address: 1st Floor 43 Great George Street, Roseau, Commonwealth of Dominica

18.7.3. The Parties agree to conduct all communication in relation to this Agreement in English. Where The Kingdom Bank sends or accepts communication in another language, this shall be for convenience only and shall not change English as the agreed language of communication for future communications.

18.8. Governing of Law

18.8.1. This Agreement and any legal relationship between the Parties arising out of or in connection with it (including non-contractual disputes or claims) shall be governed by and construed in accordance with Commonwealth of Dominica law.

18.8.2. Any dispute arising out of or in connection with this Agreement and which cannot be resolved by negotiation between the parties within 7 days of either party giving notice to the other party that a dispute has arisen shall be submitted to mediation subject to agreement between the parties to submit to mediation. Provided that both parties agree to submit to mediation the parties shall within 14 days agree between them the mediator who shall be appointed by them jointly. The costs of the mediator and the mediation process and any associated costs shall be shared equally with both parties bearing their own legal costs and expenses. In the event that the parties are unable to reach agreement on the appointment of a mediator and the mediation process within 7 days or if having submitted to mediation they fail to reach settlement within 7 days of the mediation, the dispute may be submitted by any party for final resolution by the Commonwealth of Dominica courts which courts shall thereafter have exclusive jurisdiction.

18.9. Waiver

18.9.1. Any waiver of a right under this Agreement shall only be effective if agreed or declared in writing. A delay in exercising a right or the non-exercise of a right shall not be deemed a waiver and shall not prevent a Party from exercising that right in the future (subject to the provisions of the Limitations Act 1980).

18.10. Severability

18.10.1. If any part of this Agreement is found by a court of competent jurisdiction to be invalid, unlawful or unenforceable then such part shall be severed from the remainder of this Agreement, which shall continue to be valid and enforceable to the fullest extent permitted by law.

18.11. Entire Agreement

18.11.1. This Agreement, including all Schedules and other documents referred to herein and the Terms and Conditions and all documents referred to therein, represents the entire agreement of the Parties in relation to its subject matter. Each Party acknowledges that it has entered into this Agreement in reliance only on the representations, warranties, promises and terms contained in this Agreement and, save as expressly set out in this Agreement, neither Party shall have any liability in respect of any other representation, warranty or promise made prior to the date of this Agreement unless it was made fraudulent

18.12. Variation

18.12.1. No variation or amendment to this Agreement shall be effective unless recorded in writing and signed by the duly authorised representatives of both Parties.

ANNEX I – PROHIBITED BUSINESS MODEL

You ARE NOT ALLOWED to send or receive payments as consideration for the sale or supply of:

- Alcohol sale

- Any fake, novelty, or counterfeit government ID’s, Visas, Licenses or other

- Any goods or services that infringe on the intellectual property rights of third parties

- File sharing

- Firearms and weapons (including without limitation, knives, ammunition, guns and anything that can be defined as a weapon or firearm)

- Material which incites or promote violence, hatred, prejudice or racism

- Pornography, adult material/content

- Prepaid or other stored value cards that are not associated with a particular customer and/or are not limited to purchases of particular products or services

- Precious stones/metals

- Prescription drugs, illegal drugs, drugs (including steroids, health supplements)

- Pyramid or Ponzi scheme products or third-party payment processing or payment aggregation products, multi-level marketing and other “get-rich quick” schemes or high yield investment programs

- Satellite and cable TV descramblers

- Shell Banks

- Tobacco products (including electronic cigarettes and e-liquid)

- Timeshares or property reservation payments

- Unlicensed gambling services of any type

- Unregistered charity services/ Non-Governmental Organizations

- Unregulated Forex Brokers

Note: We reserve the right, in our sole discretion, to add categories of unacceptable business models by adding such categories to our Agreement (visible on our Website) and our Policies.

ANNEX II – DATA ADDENDUM

DATA PROTECTION ADDENDUM

1. General

1.2. The terms "processing" (and its derivatives), "personal data", "data controller", "data processor" and "data subject" will, where used in the DPA, have the meanings given to them under the Data Protection Legislation.

1.3. In order to comply with its obligations under Data Protection Legislation, we reserve the right to amend or vary from the terms of this DPA without any notice requirements or prior approval. Any change will be made available in the Website within 48 (forty-eight) hours after any change. The prevailing terms shall be those of the most recent version of the DPA made available on the Website.

2. Data protection principles

2.1. We have developed its Services with IT security and the Data Protection Legislation in mind, in accordance with its primary role as a data processor and data controller (as the case may be).

2.2. You may provide data to us which will include personal data in connection with the Agreement. Each party acknowledges that we will process the personal data you provide to it:

2.2.1. for the purpose of the performance of our obligations under, and the provision of the Services pursuant to, the Agreement; and

2.2.2. for the duration of the Agreement only.

2.2. Each party acknowledges that:

2.2.1. if personal data are processed in connection with the Agreement, the categories of data subjects and types of personal data will be as specified in the Agreement;

2.2.2. we will be a data processor acting on your behalf and in accordance with your written instructions in relation to the processing of personal data pursuant to our performance of the Services under the Agreement; and

2.2.3. under certain circumstances, each party will be a data controller in connection with the processing of personal data where you provide us with personal data and we uses such personal data:

A. to comply with its own obligations under any applicable law;

B. for statistical or other analytical purposes;

C. as part of its claims management processes;

D. as part of ancillary non-clearing services that we provide to you; or

E. in any other context which requires us to determine the purposes and means of such processing.

2.4. To the extent that we act as a data processor pursuant to the Agreement or in accordance with Data Protection Legislation, we will:

2.4.1. only process personal data to the extent, and in such a manner, as is necessary for the performance of our obligations under the Agreement and in accordance with your written instructions as set out in the Agreement or as otherwise instructed from time to time, and will not process such personal data for any other purpose;

2.4.2. implement and ensure compliance with appropriate technical and organizational measures to protect the security of personal data processed by us in performance of the Services, and to protect personal data against unauthorized pr unlawful processing, accidental or unlawful destruction and damage or accidental loss, alteration, unauthorized disclosure, or access;

2.4.3. take reasonable steps to ensure the reliability and trustworthiness of employees or agents which have access to any personal data, and ensure that such employees or agents are under confidentiality obligations;

2.4.4. to the extent permitted by applicable laws, promptly notify you of any request made by a data subject, regulator or any other person requesting access to personal data processed by us and you will handle such request, and we will at all times cooperate with and assist you in executing your obligations under the Data Protection Legislation in relation to such access requests. In all cases, we will provide a copy to you of all personal data which we disclose unless prohibited by law;

2.4.5. notify you, as soon as when it is practicable, by written notice with relevant details reasonably available of a Security Incident and provide reasonable cooperation and information upon your request in relation to the Security Incident;

2.4.6. on termination, return any data to you or, at your option, securely destroy it to the extent reasonably practicable;

2.4.7 make available to you and any competent data protection or privacy authority all necessary information regarding The Kingdom Bank's data processing activities unless providing this information would be in breach of applicable laws (including the Data Protection Legislation), in which case we must inform in advance you to the extent it is permitted by applicable law to do so;

2.4.8. subject to clause 2.4.9, not engage any sub-contractor to assist us in the fulfilment of our data processing obligations under the Agreement except with your prior written consent and unless there is a written contract in place with the sub-contractor which requires the sub-contractor to:

A. be already a sub-contractor at the date of the Agreement; and

B. only carry out such processing as may be necessary from time to time for the purposes of its engagement by us in connection with the Agreement; and

C. comply with terms and conditions (and only sub-contract on terms and conditions) which provide an equivalent level of protection to personal data as set out in this clause 2.4,

2.4.9. we may be responsible for all the acts and omissions of any such sub-contractors in the performance of data processing obligations under the Agreement as if they were our own acts and omissions;

2.4.10. we will notify you fourteen (14) days in advance before engaging any data sub-processor that we have not previously communicated to you (via its relevant policies or otherwise) by directing you to an updated list of data sub-processors (or otherwise); if you wish to object to the engagement of such new data sub- processor you shall provide us with written notice of such objection including reasonable details of the grounds for your objection ("Objection Notice") as soon as possible; following receipt of an Objection Notice, we will endeavour to discuss any reasonable objections with you in good faith; if, after 61 days from the date on which we receive the Objection Notice, you can demonstrate that the new data sub-processor is unable to comply with clauses 2.4.8(B) and (C) then you may terminate the Agreement by notice in writing to us; and

2.4.11. not transfer personal data to any country not permitted, including without limitation to restricted territories under Data Protection Legislation. Such restriction will not apply if we have ensured that such transfer complies with applicable Data protection Legislation, either by having in place contractual clauses to govern the transfer or using another basis to ensure the transfer complies with the applicable law Data Protection Legislation

2.5. You hereby agree to us sub-contracting the processing of personal data to third parties from time to time in accordance with our relevant policies as communicated to you from time to time provided that we act in accordance with its obligations under clauses 2.4.8 - 2.4.10 above.

2.6. To the extent that we act as a data controller pursuant to the Agreement (in relation to any personal data provided by you or on your behalf and in respect of which you are also a data controller), we and you will each:

2.6.1. process such personal data in compliance with Data Protection Legislation and the Privacy Policy; and

2.6.2. deal promptly, reasonably and in good faith with all reasonable and relevant enquiries from the other party relating to its processing of personal data.

2.7. Irrespective of whether we act as a data processor or a data controller:

2.7.1. you will comply at all times with: (i) all applicable laws and regulations of your jurisdiction relating to the processing of personal data and privacy; and (ii) applicable Data Protection Legislation;

2.7.2. without prejudice to clause 2.7.1, each Party shall comply at all times with its own data processing, privacy and cyber security policies in relation to the processing of personal data and any cyber security incident ("Data Policies"). Within 5 Business Days following the Commencement Date and each anniversary of the Commencement Date, you shall provide us with copies of your Data Policies relating to the processing of personal data and any cyber security incident for our review. Without prejudice to your obligations under clause 2.7, if The Kingdom Bank reasonably believe that your Data Policies are not appropriate, we may require you to comply with our Data Policies, except where you are the data controller;

2.7.3. each Party will be entitled to assume that any disclosure of personal data to the other Party is done so in a manner which is compliant with: (i) all applicable laws and regulations in your jurisdiction relating to the processing of personal data and privacy; and (ii) applicable Data Protection Legislation;

2.7.4. you will provide all necessary information and notices to, and obtain all necessary consents from, any data subjects whose personal data you provide to The Kingdom Bank, so that we are able to use or otherwise process this personal data for the purposes of the Agreement without needing any further consent, approval or authorisation, and upon our request from time to time you will consult with us, and comply with any reasonable requests of us in relation to the same; and;

2.7.5. Except for our gross negligence or willful misconduct, you shall indemnify, protect, defend and hold harmless The, and its agents from and against any and all claims, lawsuits, penalties, fines, attorneys’ and consultants’ fees, expenses and/or liabilities occurred during performance of the obligations under the Agreement.

2.8. if requested by us, you will promptly provide reasonable evidence that you have provided all necessary information and notices to and obtained all necessary consents from data subjects.

2.9. Processing, Personal Data and Data Subject

2.9.1. The Data Processor shall comply with any further written instructions with respect to processing by the Data Controller or Data Subject.

2.9.2. Any such further instructions shall be incorporated into this Data Addendum or exchanged between the parties in accordance with the Agreement

Description | Details |

Subject matter of the processing | Performance of the Agreement, providing payment services and initiating Payment Orders successfully and by complying necessary AML and compliance rules. |

Duration of the processing | The term of the Agreement unless regulatory or legal obligations require more. |

Nature and purposes of the processing | The personal data received from the Data Controller will be used to process payments according to the bank payout services chosen by the Data Controller.

Collection of the data begins in the User Interface (UI) where Data Processor collects personal data from Data Controller by the post method of Data Controller. This data is transferred to Data Processor's back-end system through API call. Collected transactional details, including beneficiary and source account details are being send to transaction monitoring partner for risk assessment purposes. For withdraw transactions, transaction details are also shared with System Participant and relevant authorities in accordance with the Rules. |

Type of Personal data | National ID, birth of date, country, date of birth, place of birth, passport number, country, address, company shareholding information, post code, nationality, type of address (owned property/rent), amount of the payment, currency of the payment, transaction request date, transaction completion date, IBAN, account, type of the account, currency of the account, e-mail, bank name, account number (conditional), SWIFT code (conditional), branch code (conditional) |

| Categories of Data Subject | Customers, Personal representatives |

| Plan for return and destruction of the Personal Data once the processing is complete | We do not have a structure for deletion. The data remains in compliance with financial regulatory rules, including the Commonwealth of Dominica regulations and other applicable regulations. |

PRODUCTS & PROMOTIONS

The Kingdom Bank Ferrari 812 GTS ATELIER Giveaway

1. Organizer

This Giveaway ("Promotion") is organized by The Kingdom Bank ("Organizer," "we," "our," or "us"), an international financial institution licensed in The Kingdom Bank's supported jurisdictions.

2. Promotion Period

The Promotion runs from 9 February 2026 until 31 December 2026 at 23:59 GMT ("Promotion Period"). The Prize Draw will take place on 1 January 2027.

- One (1) Ferrari 812 GTS ATELIER (specifications to be determined by Organizer).

- Winners will be selected via a randomized draw conducted on 1 January 2027 under the supervision of The Kingdom Bank's compliance team.

The Ferrari 812 GTS ATELIER grand prize is non-transferable and non-redeemable for cash.

3. Eligibility

- The Promotion is open exclusively to verified clients of The Kingdom Bank who maintain an active trading or transaction account.

- Participants must be at least 18 years of age (or legal age in their country of residence).

- Employees, contractors, affiliates, and agents of The Kingdom Bank, as well as their immediate family members, are not eligible to participate.

- This Promotion is not available in jurisdictions where such giveaways are prohibited or restricted by law.

4. Entry Rules

- Participants receive one (1) ticket for every €500 (five hundred euros) of executed transactions during the Promotion Period.

- Tickets are unlimited; participants may earn as many tickets as their total eligible transactions allow.

- Eligible transactions are defined as exchange, card spend etc. Transactions deemed fraudulent, reversed, canceled, or in violation of The Kingdom Bank's policies will not qualify.

5. Prizes

5.1 Grand Prize

- One (1) Ferrari 812 GTS ATELIER (specifications to be determined by Organizer).

5.2 Additional Prizes (as per the official budget plan)

- 10x iPhone 16 (256 GB)

- 20x iPad Air (256 GB)

- 20x PlayStation 5 Pro

- 40x AirPods Pro 2

6. Winner Selection

- Winners will be selected via a randomized draw conducted on 1 January 2027 under the supervision of The Kingdom Bank's compliance team.

- Each ticket earned provides one (1) entry into the draw.

- Winners will be notified by email and/or phone within 10 business days of the draw.

- If a winner cannot be contacted within 30 days, the prize may be forfeited, and The Kingdom Bank reserves the right to redraw or retain the prize.

7. Prize Conditions

- The Ferrari 812 GTS ATELIER grand prize is non-transferable and non-redeemable for cash. Delivery details (including taxes, insurance, registration, customs duties, and other associated costs) are the responsibility of the winner, unless explicitly covered by The Kingdom Bank.

- Electronic prizes (iPhones, iPads, PlayStations, and AirPods) are subject to availability. Equivalent substitutes may be provided if stock is unavailable.

8. Verification & Compliance

- Winners may be required to provide identity verification, proof of residence, and compliance with local regulations prior to receiving prizes.

- The Kingdom Bank reserves the right to disqualify participants who engage in fraud, abuse, or manipulation of the Promotion.

9. Liability & Disclaimer

- The Kingdom Bank will not be held liable for delays, damages, or losses related to the prizes once awarded.

- The Kingdom Bank makes no warranty regarding the merchantability, fitness for purpose, or availability of any prize beyond manufacturer warranties.

- Participation constitutes acceptance that The Kingdom Bank's decisions are final and binding.

10. Data Protection

- By participating, entrants consent to the processing of their personal data for the purpose of administering the Promotion, in accordance with The Kingdom Bank's Privacy Policy.

- Winners agree that their first name, initial of surname, and country may be published in marketing materials, unless prohibited by law.

11. Governing Law

- These Terms & Conditions shall be governed by and construed in accordance with the laws of The Kingdom Bank's supported jurisdictions.

- Any disputes arising shall be subject to the exclusive jurisdiction of the courts of The Kingdom Bank's supported jurisdictions.

12. Amendments

- The Kingdom Bank reserves the right to amend, suspend, or terminate the Promotion at any time due to unforeseen circumstances, regulatory requirements, or events beyond its control.

The Kingdom Bank "Lunch On Us" Promotion Rules and Limitations

The following additional terms and conditions supplement The Kingdom Bank's promotional offers in connection with the "Lunch On Us" Campaign ("Promotion").

A. Eligibility

To qualify for a €50 Gift Card/Voucher under this Promotion, you must:

1. Be a director, manager, or executive-level decision-maker employed by a company that has not actively used The Kingdom Bank's services for a period of at least [6 or 12 months] prior to the start of this Promotion; and

2. Agree to schedule, attend, and complete a qualified introductory meeting with a member of The Kingdom Bank's sales team during the Promotion Period; and

3. Submit the official request form via The Kingdom Bank's "Lunch On Us" campaign landing page.

B. Promotion Details

- Qualifying participants will receive a €50 gift card or voucher ("Reward"), issued in digital format, to be used at participating merchants.

- The Reward will be sent via email within ten (10) business days after the completion of the scheduled meeting with The Kingdom Bank's sales team.

- This Promotion is limited to one (1) Reward per eligible participant and one (1) Reward per company.

- The Reward is non-transferable, non-refundable, and not redeemable for cash.

C. Exclusions

- Employees, contractors, or affiliates of The Kingdom Bank, as well as their immediate family members, are not eligible to participate.

- Companies that are currently active customers of The Kingdom Bank are not eligible.

- Meetings that are cancelled, unattended, or deemed non-genuine sales opportunities (in the sole discretion of The Kingdom Bank) will not qualify for a Reward.

- This Promotion is void where prohibited by law.

D. Additional Terms

1. Compliance – The Kingdom Bank reserves the right to verify eligibility, including the employment status and account history of the participant's company.

2. Modification or Termination – The Kingdom Bank may amend, suspend, or terminate this Promotion at any time without prior notice due to regulatory requirements, fraudulent activity, or events beyond its control.

3. Liability – The Kingdom Bank is not responsible for lost, delayed, stolen, or misused gift cards or vouchers, nor for any fees, taxes, or charges imposed by merchants.